Publications • Members Finance - Assurance - Banque

CalBank PLC organizes maiden cashless market

As part of efforts to deepen its relationship with clients, CAL Bank has disclosed of its new strategy to enable customers transact business digitally

As part of efforts to deepen its relationship with merchants and customers, indigenous bank, CAL Bank PLC has disclosed of its new strategy to enable customers transact business digitally.

According to the Bank, this forms part of efforts to drive the digitization agenda in the country and increase the adoption of the use of its digital products.

Managing Director for CalBank PLC, Philip Owiredu made this known during the bank’s first Ever Cashless Market organized in Accra. Speaking to the media at the event, he reiterated the bank’s commitment to focus on the digital transformation of its operations to enhance performance and provide access to products and services for customers at their convenience. “The aim of today’s programme is to collaborate with the Accra goods market to be able to ensure that as an institution we all understand that marketing, selling, buying, paying is literally virtual now. Now, we all definitely will go out and go and shop but in these days we also have the opportunity of being able to shop virtually. So we are collaborating on this programme to ensure that we get close to our merchants, get them to bring in people who would like shop, get to know the merchants over here, get to know the products and services offered by Cal bank so that we will be able to engage our customers on more.

There are various platforms they can use such as the CAL app, QR codes among others, Any means that you will like to use for pay, which is a digital means of payment is available here for you to make that payment,” he noted.

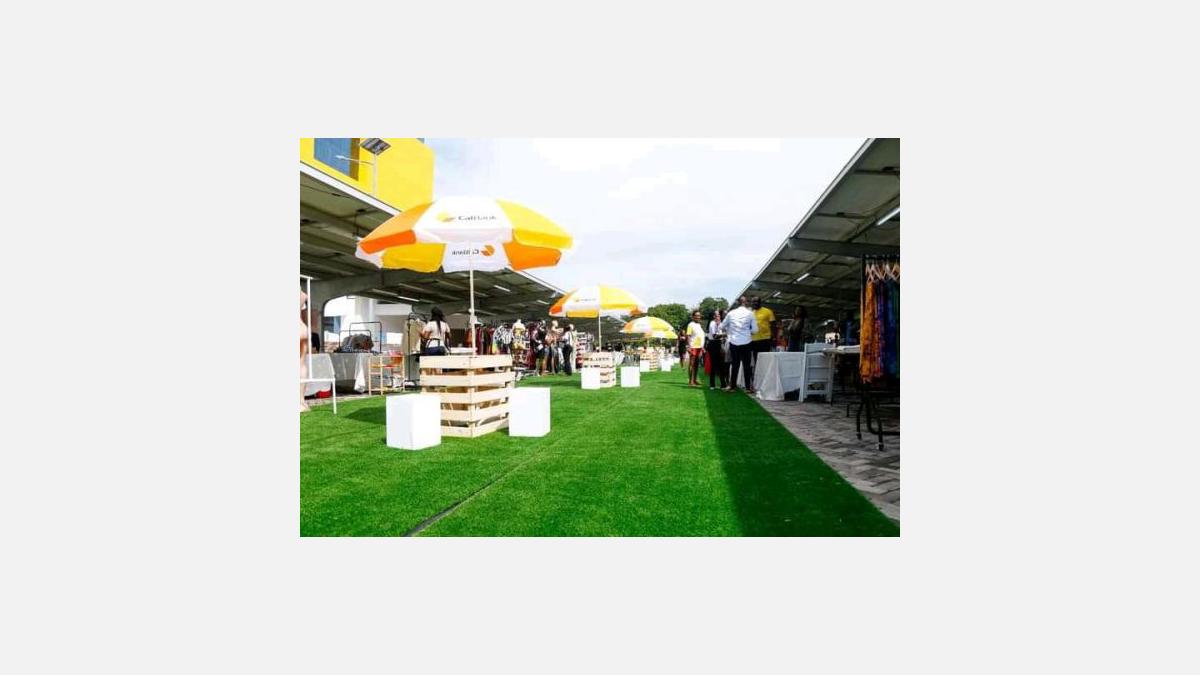

The maiden CalBank PLC Cashless Market was organized by CalBank in partnership with the ‘Accra Goods Market’. The aim of the two-day tech-driven and open-air event was to create a market access for a host of merchants and consumers.

It is essentially a pop-up lifestyle market for food, drinks, clothing/accessories for adults and children, arts, consumer electronics and music.

Some merchants and customers at the program also expressed joy at the use of the cashless systems for transacting. They spoke to Citi Business News on how the platform will boost their businesses.